All Categories

Featured

Table of Contents

It's vital to keep in mind that SEC regulations for certified financiers are designed to protect financiers. Without oversight from financial regulators, the SEC simply can't evaluate the danger and reward of these financial investments, so they can not offer details to educate the average financier.

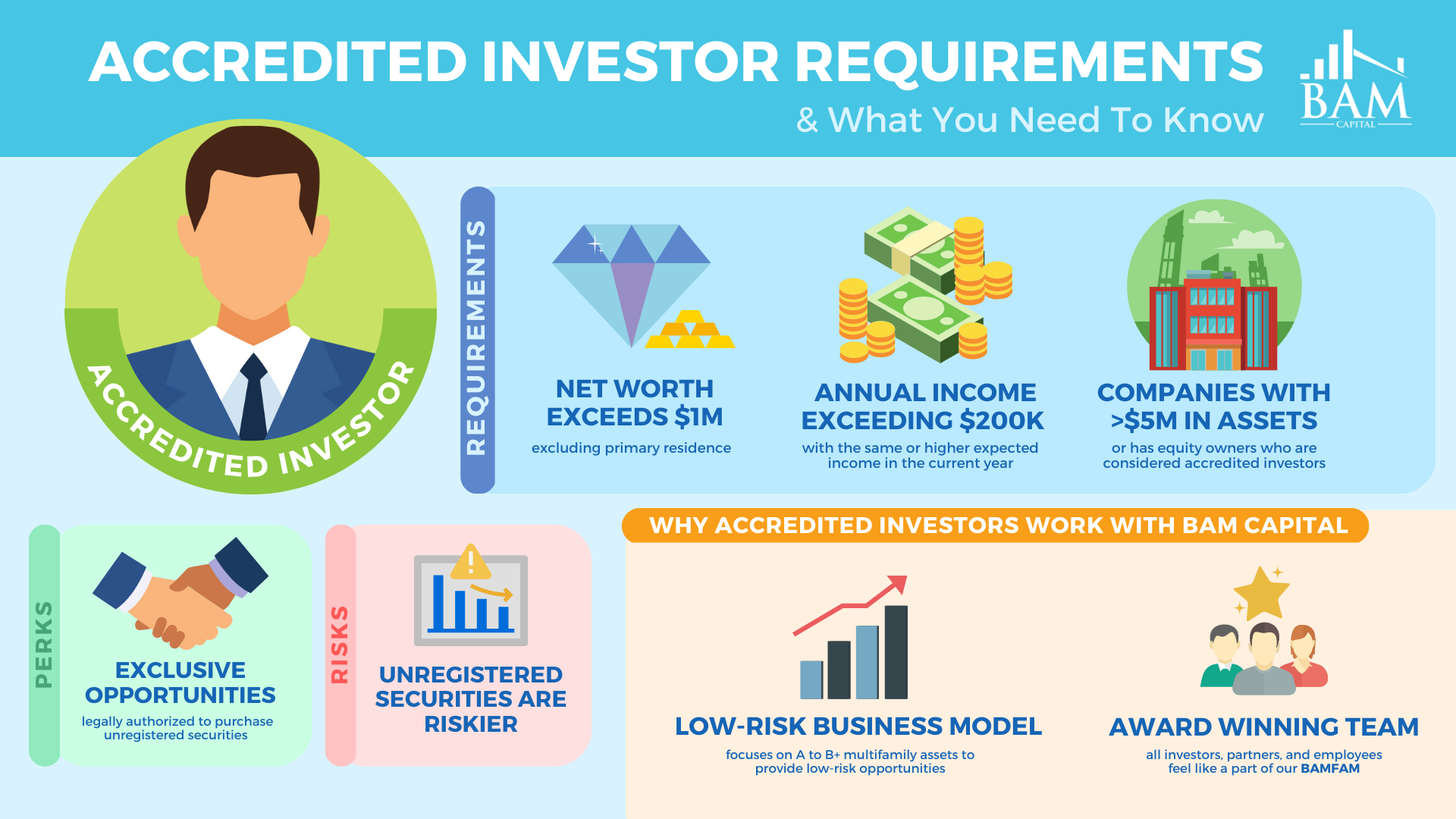

The idea is that investors that gain adequate income or have enough riches are able to soak up the risk better than capitalists with lower revenue or much less riches. accredited investor alternative investment deals. As an accredited financier, you are expected to finish your own due persistance before including any type of property to your investment profile. As long as you fulfill one of the adhering to 4 needs, you certify as an accredited financier: You have actually gained $200,000 or more in gross earnings as an individual, each year, for the past two years

You and your partner have actually had a combined gross revenue of $300,000 or more, each year, for the previous two years. And you anticipate this level of earnings to proceed.

Cost-Effective Accredited Investor Real Estate Investment Networks

Or all equity proprietors in the business certify as certified investors. Being a certified capitalist opens doors to financial investment possibilities that you can't access otherwise.

Ending up being an accredited financier is just a matter of proving that you meet the SEC's needs. To validate your revenue, you can give documentation like: Tax return for the previous two years, Pay stubs for the previous two years, or W2s for the previous two years. To confirm your total assets, you can supply your account statements for all your properties and liabilities, consisting of: Savings and inspecting accounts, Financial investment accounts, Outstanding financings, And property holdings.

Strategic Passive Income For Accredited Investors for Financial Growth

You can have your lawyer or certified public accountant draft a verification letter, validating that they have examined your financials and that you meet the needs for a certified financier. It may be more affordable to make use of a service particularly created to validate recognized capitalist standings, such as EarlyIQ or .

, your certified investor application will be processed through VerifyInvestor.com at no price to you. The terms angel investors, advanced financiers, and recognized financiers are typically used interchangeably, but there are refined differences.

Normally, any individual that is recognized is presumed to be an innovative investor. The income/net worth demands continue to be the same for international capitalists.

Right here are the most effective financial investment chances for certified capitalists in realty. is when capitalists pool their funds to acquire or remodel a home, after that share in the profits. Crowdfunding has become one of one of the most prominent approaches of spending in property online since the JOBS Act of 2012 allowed crowdfunding platforms to provide shares of genuine estate jobs to the public.

Most Affordable Passive Income For Accredited Investors

Some crowdfunded realty investments do not call for accreditation, but the projects with the best prospective incentives are typically scheduled for recognized investors. The difference between projects that accept non-accredited financiers and those that only accept recognized capitalists generally boils down to the minimum investment amount. The SEC presently limits non-accredited capitalists, that make less than $107,000 annually) to $2,200 (or 5% of your yearly revenue or net worth, whichever is much less, if that quantity is greater than $2,200) of investment funding each year.

is one of the most effective means to invest in realty. It is very comparable to property crowdfunding; the procedure is essentially the same, and it comes with all the exact same advantages as crowdfunding. The only significant difference is the ownership structure. Realty syndication offers a steady LLC or Statutory Trust fund possession version, with all financiers acting as participants of the entity that has the underlying realty, and an organization who facilitates the task.

a business that invests in income-generating actual estate and shares the rental income from the buildings with capitalists in the type of returns. REITs can be publicly traded, in which case they are regulated and offered to non-accredited capitalists. Or they can be private, in which instance you would certainly need to be approved to invest.

Top-Rated Accredited Investor Opportunities

Monitoring charges for a personal REIT can be 1-2% of your complete equity each year Procurement costs for new acquisitions can come to 1-2% of the acquisition price. And you may have performance-based costs of 20-30% of the exclusive fund's revenues.

While REITs focus on tenant-occupied homes with stable rental income, private equity genuine estate companies concentrate on real estate growth. These firms usually create a plot of raw land right into an income-generating residential property like a house complicated or retail buying. Similar to private REITs, investors in exclusive equity endeavors normally need to be certified.

The SEC's interpretation of certified investors is developed to recognize people and entities deemed economically innovative and efficient in evaluating and taking part in specific kinds of private financial investments that may not be available to the general public. Value of Accredited Investor Standing: Conclusion: Finally, being an approved investor carries substantial relevance worldwide of financing and financial investments.

Tailored Private Placements For Accredited Investors for Accredited Investors

By fulfilling the standards for accredited financier status, people demonstrate their monetary class and get to a world of financial investment chances that have the prospective to generate significant returns and add to long-lasting economic success (accredited investor financial growth opportunities). Whether it's investing in start-ups, realty endeavors, personal equity funds, or other alternate properties, accredited financiers have the privilege of exploring a varied array of investment choices and constructing wealth on their very own terms

Accredited financiers consist of high-net-worth individuals, banks, insurance provider, brokers, and counts on. Recognized investors are defined by the SEC as certified to invest in facility or advanced kinds of safety and securities that are not carefully managed. Certain criteria need to be met, such as having an ordinary annual earnings over $200,000 ($300,000 with a partner or residential partner) or functioning in the economic market.

Unregistered safeties are naturally riskier due to the fact that they do not have the regular disclosure needs that feature SEC registration. Investopedia/ Katie Kerpel Accredited capitalists have blessed accessibility to pre-IPO companies, financial backing business, hedge funds, angel investments, and different bargains including facility and higher-risk financial investments and tools. A business that is looking for to elevate a round of financing may decide to directly come close to recognized capitalists.

Latest Posts

Tax Ease Lien Investments

Houses For Sale Due To Back Taxes

Tax Delinquent Properties